WI DoR Form I-804 2024-2025 free printable template

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

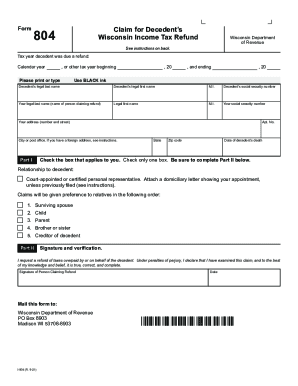

Understanding the WI DOR Form -804

What is the WI DOR Form -804?

The WI DOR Form I-804 is an income tax form used in Wisconsin to claim a tax refund on behalf of a decedent. This form serves as a crucial tool for individuals managing the financial affairs of someone who has passed away, facilitating refunds that may be owed for overpaid taxes.

Key Features of the WI DOR Form -804

The I-804 form includes several key features that streamline the claim process. These features ensure that users can identify their relationship to the decedent, declare their right to claim the refund, and provide all necessary information in a structured manner.

Eligibility Criteria for the WI DOR Form -804

Eligibility for using the WI DOR Form I-804 generally requires that the claimant is a legal representative of the decedent or an immediate family member. Individuals must ensure they meet these criteria before submitting the form to avoid potential delays or rejections.

How to Fill the WI DOR Form -804

Filling out the WI DOR Form I-804 requires careful attention to detail. Each section must be completed accurately, including naming the decedent, their Social Security number, and the claimant’s information. Using black ink and clear handwriting is advisable. Numerous resources are available to assist with proper completion.

Common Errors and Troubleshooting

Common errors when filling out the I-804 form include missing signatures, incorrect Social Security numbers, and incomplete sections. Review each entry carefully before submission to minimize errors and ensure a smooth processing experience.

Benefits of Using the WI DOR Form -804

The primary benefit of utilizing the WI DOR Form I-804 is facilitating the prompt retrieval of tax refunds owed to a decedent's estate. This process can aid in finalizing financial affairs and settling any outstanding obligations, providing relief during a difficult time.

Submission Methods for the WI DOR Form -804

The form can be submitted via mail or in person at designated Wisconsin Department of Revenue offices. It is important to verify the correct mailing address to ensure timely processing.

Frequently Asked Questions about wi form 804

What information is needed to complete the WI DOR Form I-804?

You will need the decedent's legal name, Social Security number, and details about your relationship to the decedent, along with your own identification.

Can the WI DOR Form I-804 be filed electronically?

Currently, the WI DOR Form I-804 must be submitted via mail or in person; electronic filing options may be limited.

pdfFiller scores top ratings on review platforms